The Fair Value company valuation

The valuation Of a company can differ widely between the seller And the buyer because the interests are Not the same. With the Fair Value company valuation, we offer a valuation method that represents a fair basis For both sides.

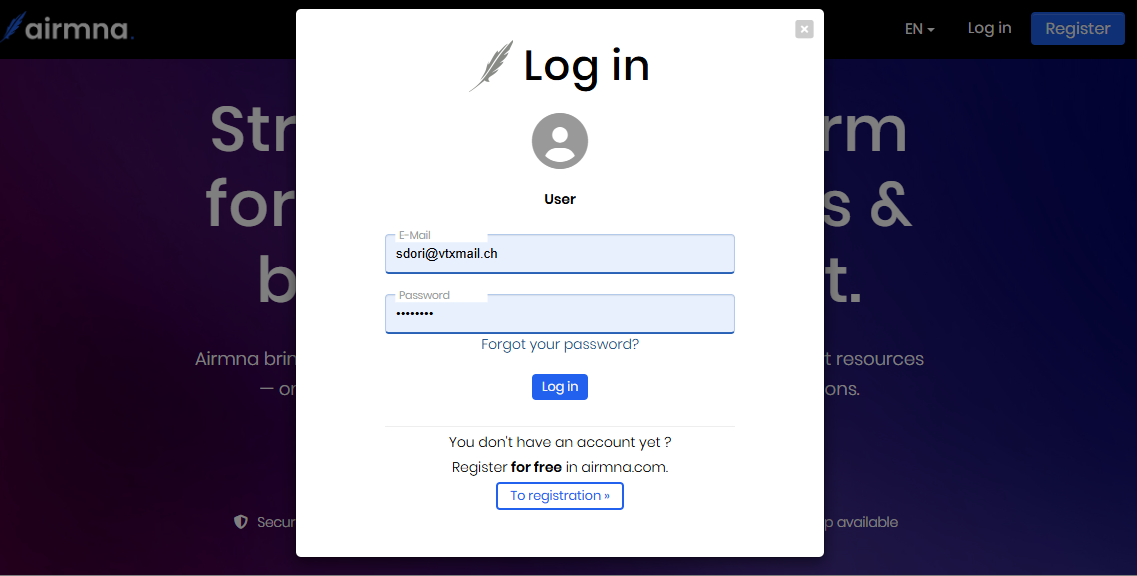

Location And security Of the cloud servers

Data transfer

An SSL connection (Secure Socket Layer) Is an encrypted network connection between a server And a client (browser). The encryption takes place When Using HTTPS.

The advertisements are published For three months. They can be republished For additional three months at a time. You will be notified by email before the expiration Date.